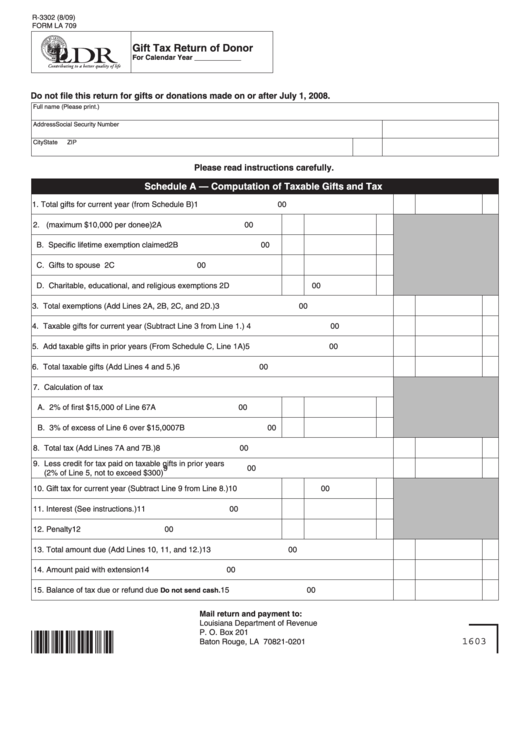

Gift Tax Return 709

Federal gift tax return that needs to be filed. Friend gifted me $500k cash in october 2022. Web but gifts that don’t meet these requirements are generally considered taxable — and must be reported on form 709 — even if they’re shielded from tax by the federal. An individual makes one or more gifts to any one person (other.

An individual makes one or more gifts to any one person (other. Upon audit, it is discovered that the gift. Web form 709 lets the irs know how you want to handle the tax. Web any consequence of not filing a gift tax return form 709.